2020–2025

Soramitsu CBDC & Enterprise

Blockchain payments and CBDC systems for central banks and governments

Brand stewardship, design leadership, and visual communications for Soramitsu's portfolio of central bank digital currencies, government financial platforms, and enterprise blockchain solutions.

Context

Soramitsu isn't a typical fintech startup. It's the company that built Cambodia's national payment system.

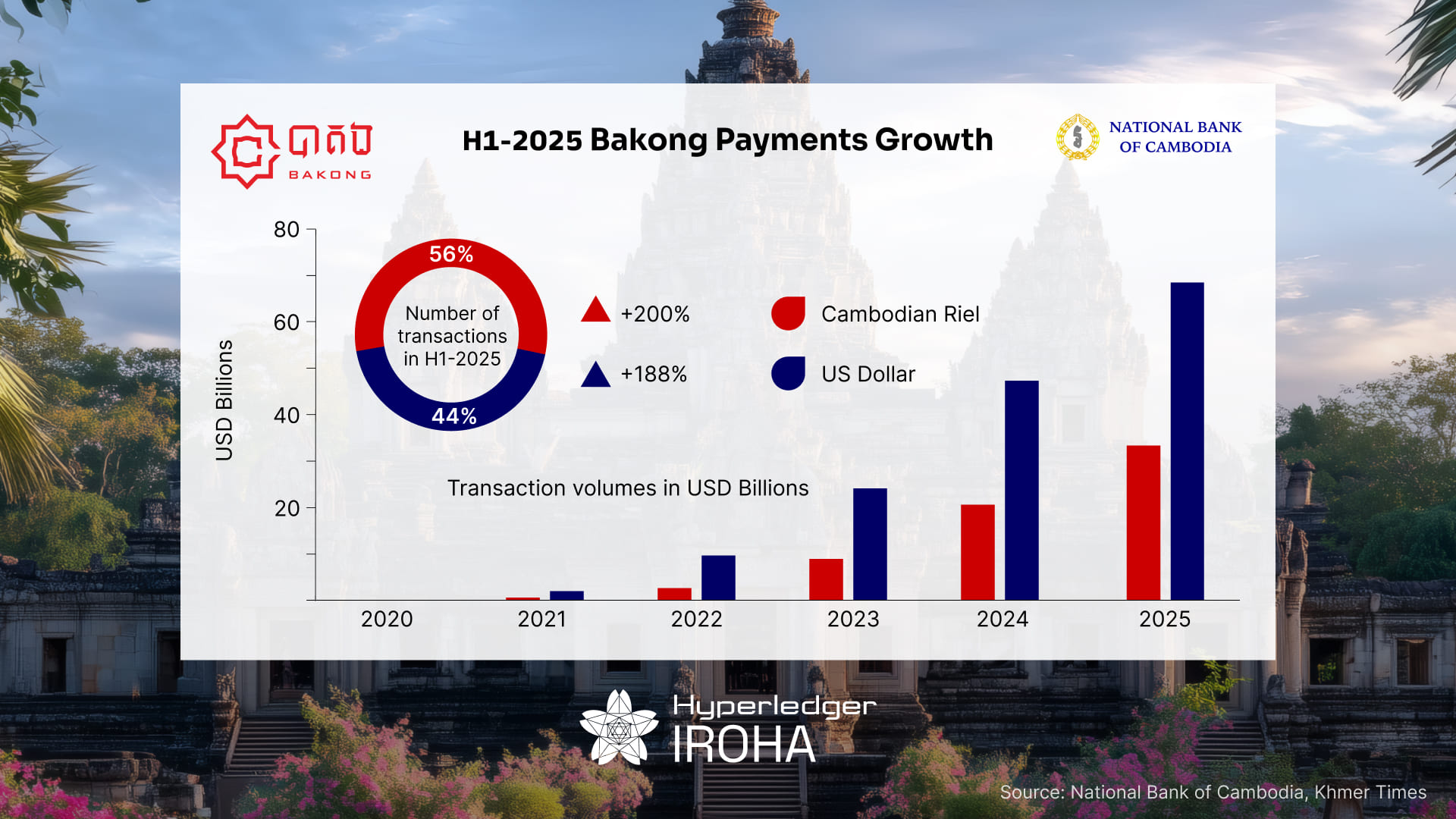

Bakong, launched in 2020 by the National Bank of Cambodia, is one of the world's first production-grade central bank digital currencies. By 2025, it had surpassed 11 million users and was processing over $500 million in daily transactions, with cross-border QR payment integrations spanning Vietnam, Thailand, Malaysia, Laos, and China (via Alipay+). It runs on Hyperledger Iroha, an open-source blockchain framework that Soramitsu originally created and contributed to the Linux Foundation.

When I joined Soramitsu in February 2020 as Head of Design and Brand, the company was simultaneously building consumer DeFi products and expanding its central bank and government work across the Asia-Pacific. My role spanned both worlds, and on the enterprise side, that meant overseeing design quality, UX strategy, brand consistency, and visual communications across a growing portfolio of national-scale financial systems.

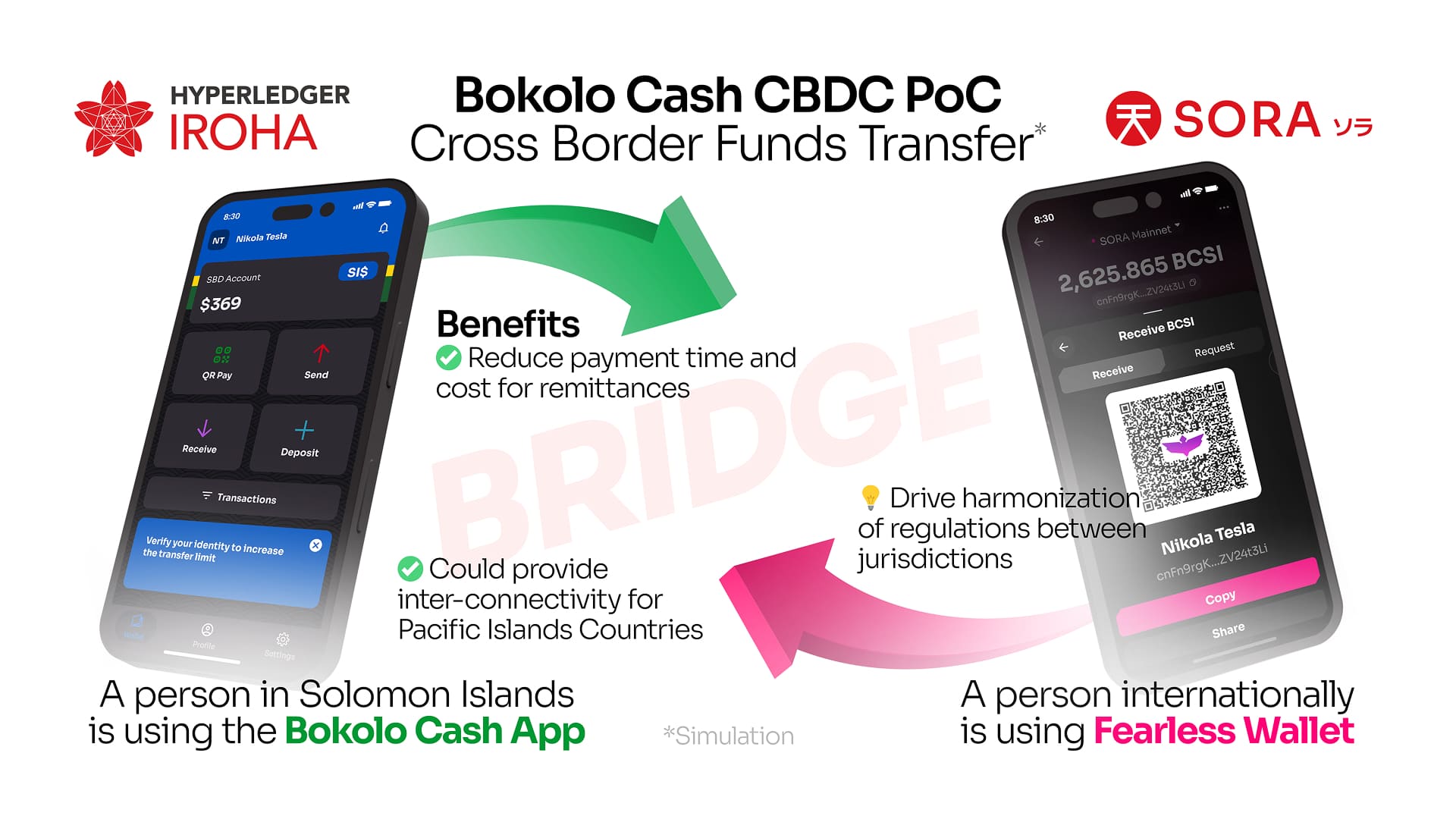

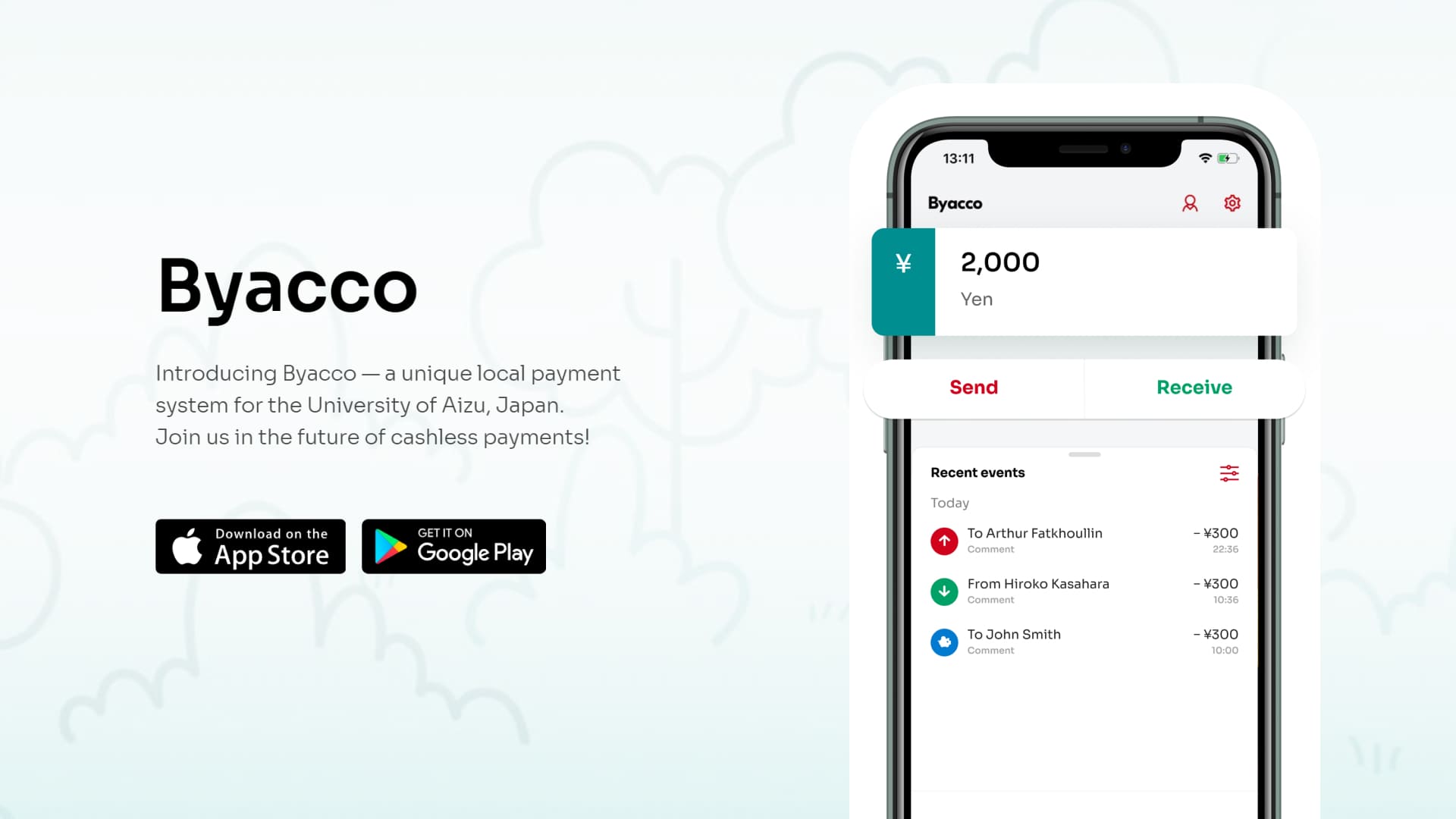

Over the next five years, Soramitsu's CBDC and enterprise portfolio expanded to include proof-of-concept deployments with the Bank of the Lao PDR (DLak), the Central Bank of Solomon Islands (Bokolo Cash), the Bank of Papua New Guinea (Digital Kina), a blockchain-based savings bond platform for the Republic of Palau (Palau Invest), developed in collaboration with Japan's Ministry of Economy, Trade and Industry (METI), and Byacco, a local digital payment system for the University of Aizu in Japan.

My Role

This wasn't a single-product design engagement. It was design leadership across a portfolio of government and institutional projects, each with different stakeholders, regulatory contexts, cultural considerations, and timelines, running in parallel with our consumer product work.

My involvement varied by project, but the through-line was consistent: ensuring that Soramitsu's enterprise products maintained design and UX quality, brand coherence, and clear visual communications — whether the audience was a central bank governor, a rural merchant in the Solomon Islands, or Japan's Ministry of Economy.

The Superwallet: scaling wallet design across countries

As the CBDC portfolio grew, so did the need for efficiency. Each new country deployment shared similar wallet functionality — account management, transfers, transaction history, QR payments — but required distinct branding, language support, and regulatory accommodations. This led to the Superwallet initiative: a multi-brand design system and modular wallet framework that enabled new CBDC wallets to be built from a shared foundation rather than from scratch. The Superwallet framework roughly tripled development efficiency and ensured consistent UX quality across deployments while allowing each product to maintain its own visual identity and cultural context.

Palau Invest: brand and design

I created the Palau Invest brand after visiting the islands and meeting with the people there myself: the logo (featuring Palau's iconic money bird rendered in the bright yellows and blues of the national flag), visual identity system and guidelines. I also oversaw the UI/UX design, crafted the product's visual communications, designed and built the Palau Invest website, and created print marketing collateral.

The product launched at a ceremony on September 30, 2024, coinciding with Palau's 30th Independence Day, attended by President Surangel Whipps Jr., Japan's Assistant Deputy Chief Cabinet Secretary, and the Japanese Ambassador to Palau.

The Portfolio

Bakong: Cambodia

National Bank of Cambodia. Production CBDC. 11M+ users. $550M+ daily transaction volume. Cross-border QR payments with Vietnam, Thailand, Malaysia, Laos, China. The benchmark for every subsequent deployment.

DLak — Lao PDR

Bank of the Lao PDR. CBDC proof-of-concept launched February 2023. Supported by JICA and Japan's METI. Targeting financial inclusion for unbanked populations and lower-cost cross-border remittances.

Bokolo Cash — Solomon Islands

Central Bank of Solomon Islands. CBDC proof-of-concept launched November 2023. Named after traditional shell currency. Tested domestic payments and simulated international remittances using SORA network bridge and Fearless Wallet.

Digital Kina — Papua New Guinea

Bank of Papua New Guinea. CBDC proof-of-concept completed 2024–2025. Focused on financial exclusion and security challenges. Real-time payments tested with local businesses in Port Moresby.

Palau Invest — Republic of Palau

Ministry of Finance, Republic of Palau. Blockchain-based digital savings bonds platform. Not a CBDC. A distinct financial product enabling Palauan citizens to invest in national infrastructure. Launched September 2024.

Byacco — Japan

University of Aizu. Local digital payment system for campus use. Cafeteria payments, grocery purchases, peer-to-peer transfers. The first local payment solution built on distributed ledger technology in a Japanese university.

Impact

Reflections

This work sits in a different category from most consumer product design. The "users" include central bank governors and island nation presidents, and the "product" is sometimes a country's financial sovereignty.

What I learned: Trust is the product. Design leadership is about enabling quality at scale. Cross-cultural design requires humility. And the best technology disappears. A merchant in Phnom Penh or a citizen in Koror never thinks about Hyperledger Iroha or SORA technology. They just interact with their money.